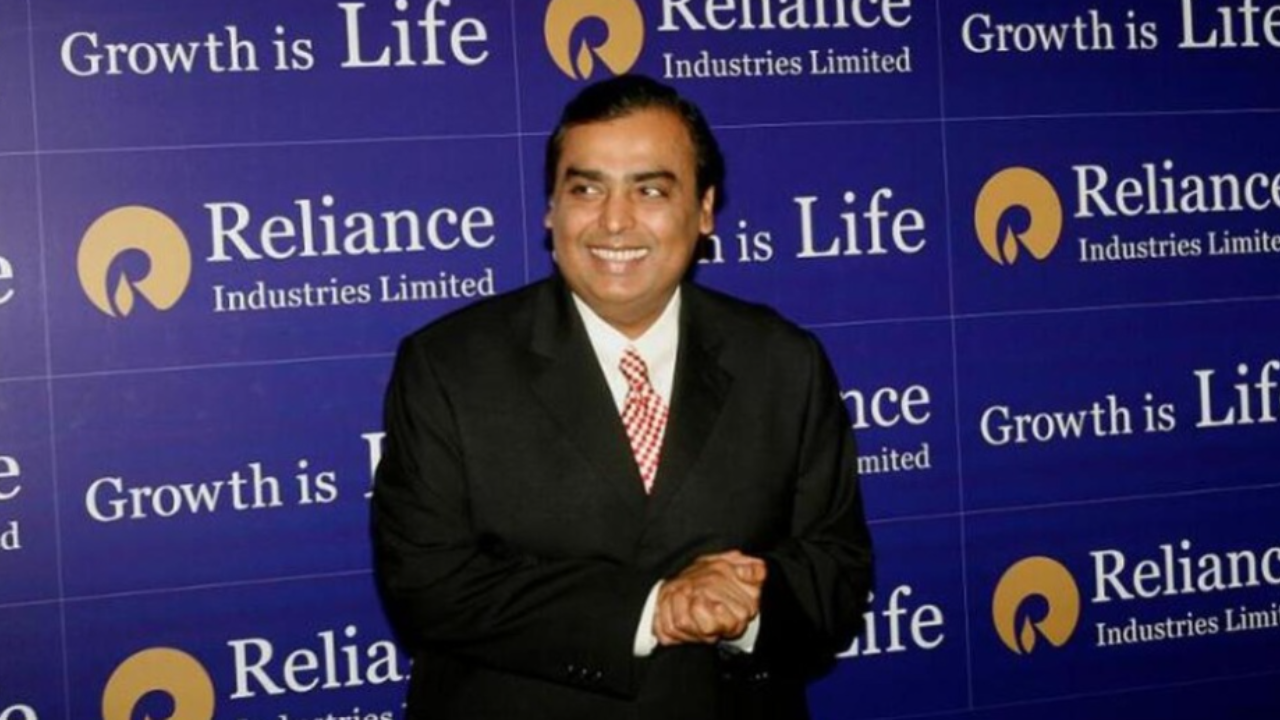

New Delhi: Reliance Industries chairman Mukesh Ambani often steals the spotlight in the business world. Reliance Group is soaring to a new height under his leadership. This time too, he is in headlines but why? Are you wondering to know the reason? Read on to find out why Reliance Industries chairman Mukesh Ambani is stealing the show these days.

Why Mukesh Ambani Is In Headlines?

As we all know the market valuation of the top ten companies out on every weekend. This week too, it was out. Reliance Industries emerged as the biggest winner in the market valuation rankings. This is the reason why Mukesh Ambani is the talk of the town.

Reliance Industries: Market Valuation

The Mukesh Ambani’s company added Rs 53, 652.92 crore to its market capitalization last week. The total market value of Reliance Industries reached Rs 20.65 lakh crore as of September 29. As a result, it has secured its position in the top spot among India’s most valuable firms.

Top Gainer

Reliance Industries, led by billionaire Mukesh Ambani, saw the highest gain among its peers.

Reliance Industries Share Price

At 11:52 am, the Reliance Industries stocks are trading at Rs 2,980.25 which is down by Rs 72.10 or 2.36 per cent. If we talk about the share price performance over the week, the company’s share price increased by Rs 59.05, closing at Rs 3,047.05.

Another Good News For Reliance Group

In addition to its market gains, Reliance Industries also made headlines for its media ventures. The Indian government approved the transfer of licenses for non-news TV channels owned by Reliance’s media arm to Star India. This move is part of a broader merger involving Reliance’s media assets and The Walt Disney Co., set to create India’s largest media empire worth over Rs 70,000 crore.

Related News |

Mukesh Ambani: Net Worth

Ambani, aged 67, has a personal net worth of over Rs 10 lakh crore, according to Forbes.

Top Companies’ Mcap

Eight of India’s ten most valuable companies saw their combined market valuation increase by Rs 1.21 lakh crore last week, thanks to a strong rally in equity markets.

Related News |